Currently the Ukrainian market of the commercial real estate is considered to be one of the most attractive investment spheres. Practically all segments of the market are growing. Presently the real estate market in general and the commercial real estate market in particular is being transformed, amalgamated and launched to operate in accordance with the rules, methods and approaches generally accepted in the world practice. Investors are turning from small building deals to major construction projects bringing the volumes of the supposed investments from just thousands to dozens of millions of US dollars and increasing the project duration from a couple of months to several years. At the same time the commercial real estate markets in some countries of the Central and Eastern Europe (e.g. Hungary, Czech Republic, Slovenia, Poland) have already entered their saturation stage and, accordingly, are offering a considerably lower profit earning power than the Ukrainian market which is believed to be promising higher profitableness today. According to the investment volumes Ukrainian companies still remain the biggest investors into this market with their Russian rivals holding the second position followed by other foreign investors.

The Ukrainian market of commercial property is a quite promising real estate market for foreign investors which can be explained by a number of reasons. Firstly, investments into the commercial real estate bring on average at least 15% yearly earnings which considerably exceeds the similar index in the European Union member-states and contributes to attracting foreign investors to the Ukrainian market. At the same time it has to be accepted that the commercial real estate market in the European Union enjoys higher relative stability than the one in Ukraine. Secondly, the high economy growth index which according to the National Statistics Committee of Ukraine attained 9.4% in 2004 is another reason for favourable forecast. And, finally, enlargement of the European Union which has turned Ukraine into its adjacent neighbour in the east with a common border has undoubtedly been promoting investors and building companies’ motivation to establish commercial, logistic and distributive centers on the territory of Ukraine.

Investment attractiveness of the segments of the commercial real estate market can be studied from the two basic points of interest – the one of short-term investments and the one of long-term investments. The office real estate segment is undoubtedly the leader in the short-term project investments. However investments into the sales real estate tend to be the least risky due to the stability in this market sector for the last years. Currently the rate of return in the sales real estate sector makes at least 15–17% in cases of investing into existing objects and at least 20–25% in cases of investing into from-the-ground objects.

Each of the commercial real estate sectors develops according to its own rules and laws. For the last few years many professionals have been speaking about saturation of the market in the field of the office real estate. In fact, this doesn’t prove to be true as many building companies often overestimate their capabilities to finish projects in time. More and more national companies become tenants and now the ratio between foreign and Ukrainian tenants concerning high-quality office areas is 60% to 40%.

The sales real estate segment of the Ukrainian market is reported to be currently dominated by foreign operators today. In Ukraine there is a shortage of national companies able to catalyze intensive development of the shopping real estate market. The potential of this segment of the commercial real estate is determined by the tenants’ ability to develop their own chains. That’s why strong quantitative and qualitative changes of all the market are considered to result directly from arrival of major European chains such as ZARA (Spain), KarstadtQuelle AG (Germany), Kaufhoff and OBI (Germany), Carrefour and Auchane (France), H&M (Sweden), Dressman (Norway), Tatti (France). The Euro-BILLA company from Austria has invested about $20 million into development of a chain of western type supermarkets in Ukraine. The Spar, a transnational company, is planning to open its first Spar Supermarket in Kiev in March 2006. At the end of April 2005 a Swedish company the IKEA declared its intention to open in Kiev a shopping and entertainment centre “Mega” with the total area of 200 thousands square metres. $350 million will be invested into this project. Since the beginning of 2007 the IKEA is going to build some more similar centres in the biggest cities of Ukraine such as Donetsk, Dnipropetrovsk, Odessa and Kharkiv.

During 2005 the rental rates in Ukraine increased on the average by 15%. However the builders have already noticed that the profitability of investments into the commercial real estate is much lower today than it used to be five years ago. Though the market of sales premises in Ukraine is far from being saturated yet, the construction companies and investors have to think more about the quality of their projects. According to the analysis of the implemented projects the profitability decline was caused by a higher demand which resulted in higher prices and rental rates against the background of higher quality requirements to the commercial real estate. Nowadays the tenants would not prefer to have just a building or a shopping object but they’d rather want a development concept of a project with improved infrastructure and skillful management able to ensure the maximum work comfort for every tenant.

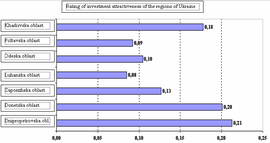

The commercial real estate market is based on a regional approach. A growing demand for high quality shopping areas is the main tendency of regional markets. According to the Ukrainian Merchant Guild the investment attractiveness rating of the regions for making decisions on investing into commercial real estate objects looks the following way:

Attractiveness rating of the regions for making decisions on investing into commercial real estate objects (Picture 1).

At present the Dnipropetrovska, Donetska, Kharkivska, Zaporizhska and Odeska oblasts(regions) where the sales premises market is the most actively developing segment are the top five regions with potentially high investment attractiveness. In terms of the quantity of the projects in the commercial real estate sphere as well as in terms of the rates of implementation of these projects Dnipropetrovsk where not only the centre but many other parts of the city are being built-up, might soon overtake Kyiv. Kharkiv represents today a relatively empty market jumping-off place. There is a dramatic shortage of the commercial real estate in Donetsk. The commercial real property deficit in this region fuels increasing of the rental payment here.

Neglecting by the most of the real estate market participators of the existing mechanisms of financing investment projects which take into account all project participators and all project implementation stages is one of the factors that slow down development of the investment projects in the real estate construction business.

Until recently a reverse order was widely used in realizing commercial real estate projects. First the construction of the investment object was launched and only after that they started looking for investors. That’s why the fund movement scheme was simplified and the investor acted in this scheme both as a final consumer and a main contractor. Or vice versa the consumer acted as an investor at the same time. The realtor within this scheme had to carry out the following functions:

- advising the construction promoter at the stage of the object design concept development;

- taking part in price setting policy;

- accepting complete responsibility for the realization process acting for the construction promoter as a sales, marketing and advertising department;

- keeping a duplicating archive of the reporting documents;

- providing the transfer of the right of ownership of the object to the investor-buyer;

- other functions non-relevant for a realtor.

Thus there were many risks impossible to foresee and avoid to say nothing of the absence of an insurance mechanism.

Though the Law of Ukraine ‘On financial and credit mechanisms and property management in housing construction and real estate operations’ came into force on 1 January 2004 only a few of the real estate market participators take advantage of the mentioned mechanisms. The law stipulates existing of two types of funds – the Construction Financing Fund and the Real Estate Operations Fund. The Executive Director can establish several funds. The funds can be created at Executive Director’s own discretion.

According to the Law means and investments can be attracted and managed exclusively by the funds specified in the Law and established as non-juridical persons (hereinafter Funds) whereas only the juridical persons registered in the State Register of Financial Institutions and possessing the corresponding licenses can act as founders and Executive Directors (hereinafter Directors). In other words the Fund appears to be a financial mediator acting between traditional subjects – construction promoters and investors. Moreover, based on fiduciary ownership the Fund acts as the executive director of the construction process (within the agreed limits) and acquires the right to control, use and own the property transferred under its management.

The problems of joint investments have also been specified at the law making level. The Law of Ukraine ‘On joint investment institutions (share and corporative investment funds)’ is the basic regulative instrument in this sphere.

State regulation of the activities of joint investment institutes (JII) and public control of their operations is provided in Ukraine by the State Commission on Securities and Fund Market (hereinafter the Commission). The basic principles and conceptual apparatus used as the basis of the Ukrainian legislation on JII and joint investments are similar to those in Western Europe, USA and Russia but with some respect of national particularities and work experience of so called voucher investment funds which used to function in Ukraine the mass privatization period.

In spite of availability of approved legal mechanisms for financing investment projects many investors don’t understand their advantages and keep working mainly for super-profits disregarding the basic project implementation requirements such as compiling high quality business plans, preparing marketing researches, making project feasibility study. Cooperation with consulting companies whose functions mostly include providing information and documentation according to the accepted format requirements and supporting the projects appears to be of great importance for investors on this stage.

At the same time despite violation of some basic project requirements many of the realized investment projects including those with foreign investments have been successful. The first projects have been implemented in the capital city. The Maculan, an Austrian investing company, pioneered the way to the commercial real estate market in Kyiv having invested and promoted the construction project which turned to become well known as the International Office and Hotel Centre (1994). The project appeared to be very successful and its premises were taken on lease by diplomatic and commercial representatives.

An A-Class business centre Podil Plaza the construction of which was invested and promoted by a Turkish company Demir Eurasian Investments Ltd was build in 2000-2003. The DTZ company was appointed the exclusive agent for giving the business centre rooms on lease.

Major western investments into the national commercial real estate have been made for the recent years by the МETRO Cash & Carry company which has built eight trade centres in Ukraine namely in Kyiv, Kharkiv, Dnipropetrovsk, Odessa, Donetsk, Lviv. Launching new trade centres in the East of Ukraine is a part of the company’s plans for the nearest future. The chairman of the Council of Directors of the МETRO Cash & Carry Ukraine Mr.Axel Lukhi said: ‘We’ll open as many shops as the number of land sites we’ll be able to get’.

The Bill-Ukraine company was founded in 1998 by the Austrian BILLA, an affiliated company of the German group REWE. The BІLLA came to Ukraine when the national chains were only originating which made it possible to expand quickly its construction activities and skim the cream off. Unfortunately the company had to cancel its business because of the unstable situation in Ukraine. Today eight Billa supermarkets are operating in Ukraine which are situated in Kyiv, Kharkiv, Dnipropetrovsk and Zaporizzhya. All the supermarkets of this chain have been constructed by the Kievgorstroy. The company is going to return to the Ukrainian market to build more supermarkets.

What makes today the investments into real estate more attractive than other investment projects? High liquidity is the main distinctive feature of the investments into real estate which is naturally taken into account by the investors when developing strategic investment plans. Real estate is believed to be the most protected investment sphere. This sector is quite different from other ones, e.g. from the market of securities where the slightest changes both in national and foreign economy or changes of the country leadership’s policy due to unpredictable administrative decisions might change the situation dramatically. Every investor would like to enjoy predictable results, stability and reliable guarantees. It’s exactly the real estate market that can provide such clear predictability and stability. Though the real estate itself is not considered as an exclusive equivalent like many other world indexes, e.g. gold or platinum, it possesses a real cost and a functional value. But exactly these factors make real estate dependent on the economic situation in particular country that is to say on the demand. Therefore the investment execution time and the actual price dynamics point must be analyzed in an extremely meticulous way. A thorough and detailed business planning based on the results of marketing researches carried out by consulting companies working in the field of implementing, developing and promoting investment projects would be also of great importance.

The data received in the course of the task-orientated analysis prove that the profitability of the commercial real estate in Ukraine can reach 60% depending on the quality of the project and the real estate segment at the moment of entering and leaving the business.

A relative stabilization that is to say a balance between the demand and supply can be expected not earlier than in 2008. Currently foreign investors seem to be mostly attracted by the commercial real estate.

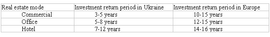

To our opinion the reasons for this particular orientation are as follows: the demand for modern sales real estate in Ukraine outgrows the supply; building supermarkets in this country looks less challenging for powerful foreign corporations with experience of constructing trade centres and chains all over the world than for the national businessmen. This advantage can be better seen visually when comparing the effectiveness of financial investments in different countries. Hereafter is a comparative chart of the investment return periods of the commercial real estate projects in Ukraine and Europe:

Thus it’s possible to conclude that the real estate market of Ukraine possesses a substantial growth potential, unsatisfied demand in all the sectors and classes of the commercial real estate and a low business competition level. New office centres are being constructed due to the fact that the market of specific office areas is far from being saturated. Compared to the countries of Western Europe, e.g. to Hungary, Ukraine has seven times more population but about seven times less office areas. At the same time the occupancy rate reaches 90%. The office market supply in Kyiv is 15 times less than in Moscow and investment profitability in this segment keeps at the yearly level of 13%-17%.

In 2007 the total shopping areas market of the trade centres in the capital city can exceed one million square metres but this is not believed to reduce the rental rates and increase unoccupied areas before 2008. This conclusion was made by Vitaliy Boiko the Deputy Director of the Ukrainian Trade Guild consulting company. This opinion is also shared by Nick Cotton the Regional Director of the DTZ Zadelhoff Tie Leung -Kyiv. According to him the rental rate will keep growing until 2009-2010. He also forecasts additional serious foreign investments and construction of new trade centre areas.

At the moment Ukraine is really quite popular on the investment market. The intentions of Ukraine to follow the European integration way will contribute to the economic environment development in the country. And finally, the undertaken analysis provides enough evidences to conclude that the commercial real estate market will keep growing and developing actively on a long term basis taking into account that the commercial real estate availability index will tend to reach the indexes of countries of the Central and Eastern Europe. Such potential activity of the Ukrainian real estate market will definitely create additional opportunities and favourable conditions for investors.