Investment attractiveness of real estate projects in Ukraine is much spoken about. It’s worth to be recalled that rapid price rise at the domestic real estate market and capital inflow in this field started with the residential real estate. High potential residential demand against the background of relatively low construction volume caused the considerable price rise. However current price indicators of accommodation led to considerable limitation of solvent demand and fall of number of transactions at the market.

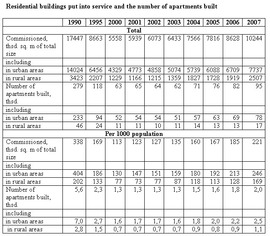

In addition, early 90-s, the first years of Ukrainian independence, were indicated by significant volumes’ fall of accommodation which was being commissioned. The tendency of living space decrease of new housing succeeded to be stopped since the beginning of the new century due to investment attractiveness growth of residential real estate that was caused by permanent appreciation in the value of property.

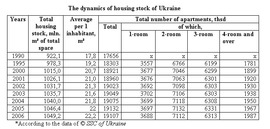

*According to the data of © SSC of Ukraine

In 2007 10,24 million sq.m of housing was commissioned 5,6 million sq.m of which was commissioned by individual developers. Ukraine is still far from indicators of 90-th but the positive growth trend of residential building is obvious.

In spite of planned increase of residential buildings putting into service which takes place against the background of permanent decrease of population, Ukraine is behind the European countries according to the level of accommodation supply per resident.

For Europe the average indicator of supply is 30-35 sq. m per person, in Ukraine according to the date of statistics it is more than 22 sq. m per person. Considering unsatisfactory condition of the greater part of built areas in pre-Soviet and Soviet times it can be affirmed, that the average accommodation supply of Ukrainian citizens is at the low level, correspondingly there is significant potential demand for real estate.

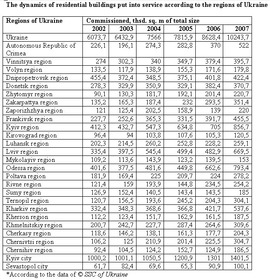

Meanwhile it should be taken into consideration that high demand for real estate is not equal in the whole country. The unsteady distribution of business activity, migration for job search, rising of country urbanization, etc., has led to imbalance of supply-and-demand of residential real estate in big cities especially in millionaire cities. Active migratory movements are typical for Kiev as the capital of Ukraine. Such situation activated permanent and rather rapid price rise for real estate which is warming up by the speculative capital which by-tern has limited investment tools in Ukraine. The irregularity of evolution could be observed in the regional aspect.

As we could observe the greatest volume of residential buildings is putted into service in those regions where the regional centre is not only the main city but it is also a regional economic centre which attracts the stream of people. First of all Kiev, Odessa, Kharkov and Lvov should be mentioned. They accumulated the main part of residential building in the corresponding regions. Also the Crimea and some western-Ukrainian regions can be mentioned where the attractiveness of periodic residence has significant influence due to recreation recourses of these regions.

It’s necessary to examine some regional markets. Particularly the leader, according to commissioned residential buildings, house prices, high demand, etc., is Kiev. Thus in 2007 1,4 million sq. m of residential buildings were put into service. The objects of “Kievgorstroi” holding company compose about 25% from the total volume of commissioned residential buildings in 2007. Also the main players of the market are CJSC “Kievgorstroi-1” by Zagorodnyi, CJSC Poznyakizhilstroy, ТIA “Liko-Holding, Ltd, “The firm TMM” Ltd, CJSC “Ukrrestavratsiya”, CJSC “The plant ZHBK im.Kovalskoy”, “UIIK” Ltd., etc. In general about 200 residential buildings and complexes are being constructed in Kiev, more than third of which is economy class. Nearly the quarter of projects is located in the central Shevchenkivskyi district of Kiev.

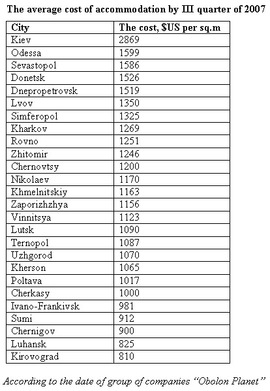

High prices (according to different data the average price of Kiev residential buildings is in the range of 2500-3000 $US per sq. m) are stipulated by significant inflow of people to the capital and relatively low volumes of lodgings’ supply. Meanwhile it should be mentioned that fixed high prices (at the average during 2007 the prices at the capital market have raised for 10-15%, meanwhile in summer and to the middle of autumn they remained stable) have led to limitation of demand for real estate and transaction decreasing at the Kiev market. According to the date of Department of Justice of Ukraine in 2007 19 520 purchase contracts of residential real estate were notarized in Kiev, that is for 22, 7% less than in 2006. Meanwhile in 2007 in Ukraine notaries certified in total 369 174 purchase contracts of apartments and housing, that is for 4% less than in 2006 and practically corresponds to the indices of 2005.

Kiev is one of the regions where the segment of elite or premium class apartments received the greatest development. Today in Kiev demand in this segment is quite high and it is supported by the high density of politicians, entrepreneurs, wealthy artists, sportsmen, etc., including those who are moving in Kiev from regions. There is no doubt that not all projects of residential real estate that are considered to be elite (at least based on fixed price) can be related to such segment, however developers are coming to the projects’ implementation in a more professional way. In Kiev in total the experts counted more than 15-20 projects of “premium” class each has one or another imperfection (location, technique, etc.) which can doubt its elitism. As expected a large part of commissioned and those that are putting into services residential buildings and complexes are situated in the centre of the capital. The prices for real estate in “premium” segment start from 7000-7500 $US per sq. m and can reach to more than 20 000 $US per sq. m for separate built objects.

By results of 2007 by the volume of commissioned residential buildings Odessa region follows Kiev and Kiev region where the main part of new apartments is being commissioned in Odessa. Thus in 2007 in Odessa region 793,4 thsd. sq. m were commissioned including 472,2 thsd. sq. m in Odessa. The main feature of Odessa housing- is that it’s main part is being in ramshackle state. In 2007 the prices for Odessa real estate were stable meanwhile the prices for old housing stock and “Khrushchev buildings” even declined. In the course of the past year the demand for residential real estate was at the lower level in comparison with the previous years. Thus according to the data of Department of Justice of Odessa region in 2007 18 612 transactions were certified that is for 26,8% less than in 2006.

At Odessa real estate market both kind of companies are present, those which implement 1-2 projects and those which have projects portfolio. “Progress-ostroi”,”Istok-2001″,”Bereg-group”, “Chernomorgidrostroy”, the company group “Alliance”, the group “Primorye”, etc., can be added to the main players of Odessa real estate primary market. About 150 residential buildings and complexes are being implemented in Odessa that is supposed in total the building of 2 million sq.m of apartments.

The residential real estate market of Dnepropetrovsk is dynamically developing too.

Creation of rather original real estate projects is the positive trait of the market. In 2007 in Dnepropetrovsk region 422,4 thsd. sq. m were commissioned, including 200 thsd. sq. m directly in Dnepropetrovsk. Currently more than 200 real estate projects are at the different stages of implementation. Meanwhile the deficit of land plots is present. In total the main players of Dnepropetrovsk construction market are about 20 big local and several foreign companies.

High prices for real estate with a potentially high and unsatisfied demand have led to a great interest of foreign investors and businessmen in the Ukrainian market. There are very high rates of profitability despite of high corruption level and the profits which can be received encourage individual developers to start their projects. Thus the project of International Holding Scorpio Real Estate, which operates in Ukraine under the brand Seven Hills, is at the construction stage. The company implements the project of the large residential complex in the Goloseevskiy region of Kiev. There are also examples when foreign investors start projects in Ukraine, involving local partners who could facilitate the solution of land and adjustments issues. Although there are examples of failures of foreign players at the domestic market, such as international group HANNER, which left the projects in Kiev after series of scandals, but it continues projects’ implementation in Ukrainian regions.

Based on the previous facts we can note that factors catalyzing price rise for real estate or its supporting at the high level are:

- Ukrainian citizens are not well provided with accommodation (in comparison with European rates)

- Poor quality of considerable part of existing housing stock and desire to improve the living conditions

- Low awareness of citizens and legal entities about other ways of investments apart from investing in real estate

- Cost increase of rent what encourages to buy real estate

- Migratory movements to big cities stimulating increase in demand for accommodation

However there are number of factors that can stimulate decline in prices for real estate:

- significant imbalance between the cost of real estate and citizens’ incomes (sometimes in Ukraine these ratio exceeds the corresponding rate for European countries )

- High current prices for real estate (influence on prospective customers’ purchasing power)

- Considerable hardening of conditions to receive mortgage credit (term, interest rate, the amount of initial instalment, hardening of requirements). This factor can significantly influence on the market as the current level of prices gives the opportunity for many people to buy accommodation only with the help of attracting credit resources

The degree of influence of the mentioned factors in each region and/or settlement is not the last thing depends on regional peculiarity as still not in every region the question of price rise is settled. However it should be noted that in a long-term outlook the demand limitation, including inaccessibility of the lending can cause the regressive supply. But the price fall of itself including primary market shouldn’t significantly affect the investment attractiveness of residential real estate. The reason is that in many regions (Kiev, Odessa, the Crimea, etc.) current prices for real estate significantly and sometimes in times exceeds the costs of construction. That’s why the price fall that is capable to stimulate the quantity of sale transactions can turn out for the best for real estate market of Ukraine.