Financial recession affected all the spheres of Ukrainian economy. Real estate market suffered as well. If the profit of construction business was equal to 250-300% during 2005-2008 those figures seem utopian nowadays.

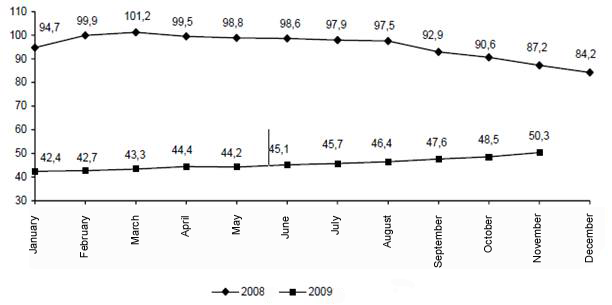

Construction volumes declined. According to the data of Statistic State Committee, from January to November 2009, the volume of realized construction work is 33.1 billion UAN. This makes half of volume of realized construction work in 2008.

* Statistic State Committee

Most construction companies are currently on the verge of bankruptcy. Construction works are often provided by not more than 5-6 workers per construction project. In some cases building crane is used only 2 or 3 times a day, simply to create an impression of continuous work for investors… The following question arises: “How long will it take to finish the facility?” Construction of most facilities is frozen that is why construction boom is not expected in the nearest future.

Hotel real estate looks the most attractive today.

Undoubtedly, preparation to the 2012 UEFA European Football Championship is a chance for Ukraine to improve hotel infrastructure and approach development standards of EU countries. On the one hand developers expect simplifying of the permits procedure on the other hand implementation of government infrastructure projects to reduce necessary expenses, which one bears for certain purposes. Though authorities have not yet taken decisive steps forward.

Hotel real estate is promising due to low level of competition. Currently the lack of high quality hotels is obvious.

Therefore, almost all projects, which should be put into operation in 2010-2011 are luxury ones. International operators will manage the following projects:

- Fairmont Grand Hotel Kiev (Kiev, str. Naberezhno – Kreschatinskaya) – 2010-2011;

- Park Inn (Dnepropetrovsk) – 2011;

- Holliday Inn (Kiev, str. Antonovich) – 2010-2011;

- Hilton (Kiev, bvld.Shevchenko) – 2011;

- Opening dates of Crowne Plaza (Kiev) and Novotel (Lviv) are still unknown

Yet possibilities of hotels opening according to schedule are uncertain. Few companies are ready to perform financial obligations fully, taking into consideration political and economical conditions of Ukraine and expectation of market redistribution.

It is almost impossible to attract investment due to influence of recession on real estate market, hotel real estate particularly, and low quality of investment projects. Marketing research, concept development, business plans, management agreements, etc. are absent. Loans are also difficult to access due to high interest rates. Even if it is possible to take loan for hotel project, security will be a problem.

All these factors resulted in demand decrease and supply increase on the hotel real estate market.

Most hotel projects are frozen, particularly work on objects are at the infant stage or delayed. Other owners, who failed to attract investment before recession, are ready to sell the projects with hope to reimburse at least some project expenses. Better situation have those, who constructed/renovated at their own expense or who has projects at the final stage.

Some developers of multistoried and office buildings, especially if they are situated in the prestigious or central parts of the big cities of Ukraine, started to work out variants of operation of their property as hotels due to impossibility to sell flats, thus they will attract tenants to offices in current situation. Moreover, developers consider creation of shopping malls in complex with hotels. This, they think, will increase payback of projects.

Serious drawback of Ukrainian market is absence of foreign investors who are disappointed in local partners due to their incompetency in project development. Obvious fact is that investors mistrust Ukrainian developers, corruption in process of siting, and quality of approval documentation.

Hotel real estate market declined due to the fact, that foreign investors cannot find high-quality hotel projects and existing hotel prices are exaggerated. Financial recession resulted in reduction of land plot and unfinished construction project prices on the one hand and in increase of correspondent supply due to desire of non-core investors to leave that kind of business. Land plot prices has fallen in some cases up to five times, but this price is still unreal if to take into account fact, that land plot is sold as investment project, without all necessary components of project.

It sounds banal, that over some period the main tendency of Ukrainian hotel real estate market is delay of realization terms and postponement of putting into operation hotel projects. As it has been mentioned such tendency is caused by lack of financing. Lack of financing in its turn is caused by low-quality projects and incompetent management. Almost all hotel project owners, who announced desire to attract financing, do not have even business plans, as they think, in such a way they provide policy of minimizing expenses in current situation of recession. Some of them have been looking for investment for some years, but have not yet counted payback and recurrency of funds, but mostly owners are not ready to take loans, as they understand that their lien will be discharged and correspondingly involve partners for joint projects.

Currently almost all Ukrainian hotels are on sale: due to financial recession increased payback period and due to debt securities of hotel owners. So far only hotel Leipzig was sold. Former hotel Leipzig, after years of renovation, was sold for 35 million dollars.

Comparing cost of hotels in 2007 to those in 2009, hotel cost today is 40 – 68 % lower. But current prices are slightly exaggerated. Sales value of one room is too high in comparison with that of developed countries, if average sales value of one room in Europe is 800k USD, in Ukraine value is from 700k USD up to almost 2 mio USD.

Most hotels, which were built in post Soviet times, are ready to sale, but it is impossible due to low ceilings, small area of rooms, infrastructure, which cannot be rebuilt. Cost of such hotels is evidently exaggerated.

Not less than 65% of all deals on the hotel real estate market of Ukraine will be purchase mostly by foreign investors of finished hotels, which will be reconstructed/completed in 2010.

Recovery of hotel real estate market will take place approximately in the middle of 2010, after stabilization of political situation in Ukraine. The increase of activity on the marked should be expected with improvement of situation within whole real estate segment and general economic growth of Ukraine.