The mini-hotel category includes all kinds of hotels with up to 30 rooms. However there is no clear-cut difference between the concepts of a mini-hotel and a hotel. There exist mini-hotels with 45 rooms as well as small hotels with less than 30 rooms. It is not only the number of rooms that plays an important role but also the way a hotel positions itself on the market. In essence a mini-hotel is considered to be more domestic and comfortable than even the smallest hotel. Sometimes mini-hotels consist of flats in old houses reconstructed and decorated in a specific manner.

It’s interesting that the term ‘mini-hotel’ itself is mostly used in the former Soviet Union countries. In the West this hotel category is usually known as ‘boarding houses’ or ‘pensions’. Today there are several hotel operators specializing particularly in such hotels. As a rule they are small hotels with different names and different owners but possessing some of the features relating them to this category, for example Small Luxury Hotels of the World (brand that resulted from amalgamation of the Prestige Hotels Europe and the Small Luxury Hotels & Resorts of North America), Elegant Small Hotels (USA), «Microtel Inns» (USA), «The Leading Small Hotels of the World» (USA).

The mini-hotel sector found and worked up its niche and created its pool of customers all over the world quite a time ago. This kind of independent business has been actively developed in Russia and other CIS countries, particularly in the city of Saint-Petersburg. The first mini-hotel chains such as Douglas, Atmosphere, Amulet, Stable Line made their appearance also in Russia.

Against a background of an increased demand for mid-price hotels in general a significant growth of the mini-hotel segment has been also noted in Ukraine where the quality level of the services provided by mini-inns is at least not lower than that of major hotels and sometimes even much higher. Businessmen and individual travelers the number of which in Ukraine increases by 10-15% every year are the main customers of such hotels.

Currently the home hotel market in general and its mini-hotel segment in particular have at their disposal a number of favourable factors contributing to their active development. The Eurovision 2005 Song Competition which took place in Kiev played an important role in expansion of the hotel services market. The number of tourists visiting Ukraine during 9 months of 2005 increased by 14% compared to the similar period of 2004. About 13 million people enjoyed the Ukrainian hotel services for the mentioned period including 1.4 million foreign tourists.

The inrush of foreign travelers made the capital city hotel managers to consider not only the new hotel construction projects but also improvement of the services quality. This also stimulated the mini-hotel system development. However, imperfect legislation is a drag on prosperity of mini-hotels. The year of 2005 brought a number of problems to hotel businessmen caused by canceling preferential investment and taxation in Free Economic Zones (FEZ) and Priority Development Areas (PDA), by attempts to restore hotel taxes, etc. Thus both hotel managers and travel agents speak in favour of preferences for hotel business subjects which could improve material resources of the tourist accommodation objects and create favourable conditions for attracting investments and fair competition on the market.

Nevertheless, last year more than a hundred of such objects in the Crimea, Carpathians, Capital cities and other towns joined the market. Development of this sector in the Crimea looks most typical. Today the Crimean Coast is spangled with mini-hotels and the number of these has been growing. According to the press-office of the Ministry of Tourism 5,193,247 travelers visited the Crimea last year. The discussed hotel segment has been also developing in the Carpathians. Lately, a new private hotel The Quelle Polyana in the Transcarpathian Region has been qualified as a 4-star accommodation entity. The data of the press-office of the Transcarpathian Regional State Administration prove that in 2005 the number of tourists visiting Transcarpathia increased by 22% compared to the previous year. The money equivalent of the volume of services provided in the tourist industry of the region grew up by 26%. In both areas tourists make up the target customer segment. Now what concerns the capital and other cities. Unlike the Crimea and Transcarpathia where the customers are mostly tourists, other regions are frequented by people who travel on business and the Capital City enjoys both categories equally.

It’s difficult to analyze in details the mini-hotel segment concerning the structure of investments and ownership as this market is considered to remain ‘grey’. However experts can identify the most typical models for establishing mini-hotels. For example, the owners of flats rented on a daily basis often come out with creating a small hotel. One by one adjacent flats are bought, then the whole level or entrance with establishing a unified reception and concierge services. As the result a mini-hotel shows up. The most spread way to establish a mini-hotel looks like following. People who used to invest money into purchasing real estate in city centres came to the conclusion that establishing a mini-hotel was the most effective way to utilize such property. Entrepreneurs rarely agree to invest into rented real estate possessed by another owner (including the state) even if the expenses are lower.

In general the development tendencies of this sector on the Ukrainian market are positive and are strongly believed to result in increase of the number of mini-hotels in the nearest future. First of all this is due to reducing the investment return period compared to that of major hotels. Today it makes 3 to 5 years. Beside this factor the demand for mini-hotels keeps growing. The customers tend to prefer small hotels with a feeling of home comfort, domestic warmth and individually targeted respect as well as more attractive prices for living.

Concerning the investment climate in Ukraine, it’s worth pointing out that the Ukrainian legislation is not very conductive to attracting investments into building new hotels to say nothing of mini-hotels. However, in order to draw investors’ money into development of the tourist industry infrastructure, the State Tourist Administration proposed to change some laws, in particular those that forbid to privatize health resort objects (sanatoriums, rest centres). The State Tourist Administration’s idea is to allow privatizing of health resorts on the assumption of preserving their end use profiles.

Attracting investors to development of the tourist industry infrastructure is possible only by means of introducing more attractive game rules on the market. Currently the State Tourist Administration together with the Ministry of Economics are developing a new law intended to attract home and foreign investments into construction and reconstruction of hotels. The investors are proposed to be freed from paying 20% VAT for purchasing and importing special equipment, which is not produced in Ukraine. It is also proposed to cancel the VAT (to make the tax rate equal to 0%) for construction services related to building health resort objects for the hotel industry.

Today a positive tendency in modification of the legislation is clearly displayed. For example, the draft resolution of the Government ‘On the order of providing temporary accommodation services by juridical and physical persons’ is about to be prepared. Being approved this document will finally solve severe disputes on which companies in the tourist sphere have to be registered as subjects of entrepreneurial activities and who can work as a physical person. By the way, the owners of mini-hotels with less than ten beds will have to fill in an income declaration (once a year). In fact private mini-hotels in Ukraine will get the chance to make their business legal.

In general, a positive tendency in development of the mini-hotel segment in Ukraine is clearly displayed. Actually, there were no mini-hotels at all in 1991 when the Soviet Union disintegrated as well as during ten years afterwards. Since 2000 this separate market segment has been developing step by step causing the growth of the number of mini-hotels in Ukraine.

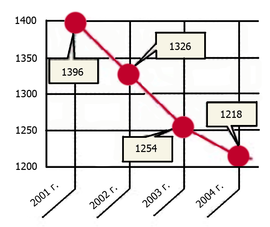

Picture 1. The number of hotels in Ukraine.

The reference source: newspaper Business #47(670) of 21 November 2005.

According to the information on the current total number of hotels in Ukraine it can be pointed out that there are only 250 mini-hotels in the country which makes 20% of all hotels in Ukraine. Taking into consideration that the development rate of this sector keeps speeding up it’s possible to state for sure that there will be about 1000 mini-hotels in Ukraine by 2010.

The Otrada hotel in Odessa is one of the most successful projects in this sector. It has 26 rooms, a restaurant, a bar, a fitness centre, an open air swimming pool on a summer terrace, a beauty parlour, a guarded parking site and a garage. The hotel considers itself a premium-lux category accommodation business. However this hotel doesn’t position itself directly as a mini-hotel. It’s worth mentioning the Poseidon mini-hotel in Kiev which has only three rooms but at the same time runs a restaurant and a sauna. About 50 mini-hotel businesses are prospering at the moment in the Carpathians. The number of mini-hotels in the Crimea approaches 100. The Edem hotel in Simeiz with its 17 rooms, sauna, billiard, sports site, parking and restaurant could be described as one of the most successful on the peninsula. The Eney mini-hotel has been opened in Lviv recently. It has 14 comfortable rooms, a bar, a restaurant, an open air cafй, a billiard, a sauna, an open air swimming pool and a parking site. The customers can also enjoy massage services here and take advantage of a body fitness device.

It should be mentioned however that foreign investors often feel uncertain about investing into the Ukrainian hotel market. First of all they are interested in the transparency of financial operations, clear tax scheme and of course in acceptable earning power ratios. It also should be taken into account that Ukraine is still believed to be a high risk country concerning economy and politics. Nevertheless, it’s worth stating that the mini-hotel segment is facing not only quantitative but also qualitative growth in the nearest future.

At last two important regulatory documents intended to govern the hotel business came into force in Ukraine. They are ‘Tourist services: general requirements’ and ‘ Tourist services: hotel rating’. The new instruments bring the European standards to the Ukrainian market; specify the basic terms, procedures and time schedule for structuring new and reconstructed hotels. 2005 turned to be a year of fundamental changes on the market of hotel services caused first of all by the obligatory hotel certification procedure.

It should be underlined that partnership as a method of doing business is the most typical way of the mini-hotel segment development in Ukraine. Moreover, for many agents this business is not the only one. It’s reasonable that many investors follow the principle ‘not to put all the eggs into one basket’ in order to ensure an alternative source of income. Taking into account that mini-hotels make a part of small and medium business, it’s important to point out that positive tendencies in this segment present reliable evidences of stabilization of the Ukrainian economy. And naturally the most attractive elements in this respect are the low investment ‘porch’ for entering the market and the fact that the business is undoubtedly promising.