The question we have to face here is how attractive the residential real estate market of Ukraine can be for investing. Judging from the current situation on the residential real estate market of Ukraine it seems possible to predict two extremes – on one side the prices of the residential real estate could be expected to increase even more, on the other side a slump of prices as well as a collapse of the whole financial pyramid cannot be excluded. The situation might turn even more unpredictable after bringing recently to light of a major fraud which caused losses of more than 400 million UAH and affected more than 1.5 thousand customers. Cases were discovered when two or even three buyers were contracted to take share in construction of one and the same flat. What will happen to the market then? Moreover, growth of the Gross Domestic Product (GDP) in the construction sector of Ukraine reduced by 6.6% in 2005 and residential housing prices rose by 50-60% in the same year in spite of the fact that the income of the population grew up only by 40%. Nevertheless, there was no capital outflow from the real estate market and thus reduction of residential real estate prices seems hardly probable in the nearest future.

Currently the population’s demand overbalances the supply of the construction industry. Until such imbalance exists the prices won’t go down significantly. The speed of construction is reported to be slowing down on the primary residential real estate market while on the secondary one the demand is going up even for out-of-date housing. Anyway, the demand for residential space is still observed in Ukraine. Several millions of the Ukrainians don’t have their own flats or houses yet and many of those who do are not quite happy with their quarters. An average Ukrainian has nothing but to enjoy only 22 square metres of floor space. One of the reasons for the increased demand is the shortage of options to invest money. Additionally, the growth of the demand is encouraged by credits which are getting more and more accessible. Concerning the supply, there is only one thing to be pointed out – the residential real estate market is not sufficiently competitive yet.

Two-level and three-level apartments find the quickest market sale today. Such apartments have considerable advantages compared to ordinary big one-level flats. It’s quite a challenge to sell a big floor space flat at the moment while two- and three-level apartments can be easily divided into several independent accommodation units. It’s economically advantageous to lease out two- and three-level apartments on a daily basis or as offices for major companies. At the same time, only 2-5% of potential buyers are really interested in purchasing this type of housing. The demand seems to be restrained by high prices in this segment of the residential real estate which are additionally pushed up by a considerable recent increase of prices for ordinary flats.

The cottage building concept appeared in Ukraine about 10 years ago but its implementation has been launched only recently. More and more people feel like living in a country house. Cottage construction market is orientated at different groups of population (low, medium and high level needs). Currently the demand on this market overbalances its supply. Fast-growing prices for apartments gradually dispose well-to-do customers to buying or building their own country houses. Following the price behavior for the last 5 years one can see that prices for residential real estate have been galloping since 2001. For example, in 2001 100 square metres of land cost in Ukraine in average $100 to $2,000, in 2002 – $200 to $6,000, in 2003 – $300 to $8,000. Today 100 square metres of privatized land for cottage building cost $8,000 to $15,000 and the upper price limit of a ready built cottage in the suburbs of the capital city reaches $2.5 million. The number of cottage towns is expected to increase within the nearest 2-3 years and the quantity of hectares of land assigned for building cottages will go up more than 3 times. According to our analysis this might bring the cottage construction land price down by 35%.

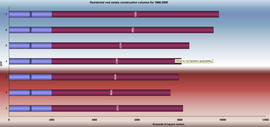

The demand for residential real estate differs from region to region. Many investors show their interest in the southern regions of Ukraine considering them more hospitable for major residential real estate projects than other parts of the country including the capital city of Kiev. Motivation for construction projects in the Crimea is permanently growing. Nevertheless, most of the projects are still being realized in Kiev followed by the Kherson Region, Odessa Region and Dnepropetrovsk Region. For 11 months of 2005 construction of residential real estate reduced in the Zakarpatska and Khmelnitsky Region. The price is forecast to be adequate to the situation on the market. It might change by maximum 1.5% but isn’t likely to fall. At the same time, residential construction sector tended to grow in 8 regions of the country led by Ternopol Region (8.4%), Ivano-Frankovsk Region (8.2%) and the city of Kiev (5.5%). Since 1980 the biggest yearly residential floor space in Ukraine (21.3 million square metres) was put in commission in 1987 followed by recession that lasted until 2001. A more demonstrative visual dynamics of residential construction volumes for the last 7 years (1999-2005) can be followed in Picture 1.

Picture 1. Construction volumes of residential real estate for 1999-2005.

In 2004 construction of residential real estate in Ukraine increased by 17.6%. in 2005 the volume of residential floor space put in commission increased by 3.3% compared to 2004 from 7 million 566 thousand square metres to 7 million 816 thousand square metres. In 2006 construction volume of residential real estate is going to increase by 25%.

In the current situation normal rate of price increases for housing in Kiev is 1-2% a month or 12-25% a year. Since the beginning of 2005 the cost of 1 square metre of floor space increased by 30% of which 20% owing to materials cost rise and 10% – to the labour cost. But during the last 3 months of 2005 the prices for residential real estate (apartments) in Ukraine fell by $2-3 thousand. In February 2006 an average one-room flat in Kiev would cost approximately $53,500 ($1,062 – 5,310UAH for 1 square metre), two-room (one-bedroom) flat – about $71,500 ($963 – 4,815UAH for 1 square metre) and three-room (two-bedroom) flat – $90,900 ($925 – 4,625UAH for 1 square metre). Prices in other regions of Ukraine are 10-12% lower than in Kiev due to the fact that Kiev is the capital city. Currently the real estate market is in a stagnation condition. After galloping in 2005 real estate prices reached their peak and relative stabilization has been observed since then.

There is a number of problems and drawbacks in the sphere of residential real estate which have to be solved in order to encourage attracting new investments into the field. The first of them is that until recently nobody used to control the activities of all construction companies licensed to build residential houses. Since 2001 about 53 thousand licenses for construction activities have been issued. However, only about 37 thousand of design and construction companies were working in the construction industry as of January 1, 2005 and there was no information on the activities of the rest 15 thousand licensed entities. This made the President of Ukraine sign a special Decree on March 3, 2006. According to this Decree all licenses for any activities related to designing and building residential houses should be re-considered and re-issued.

Another problem for investors is the process of conciliation, allotment and registration of construction sites. This procedure is very complicated and long. It must be simplified and accelerated. Moreover, every city has its own regulation standards which are also very important. According to builders, it takes more time to cope with administrative issues between choosing a site and laying the first stone than to build a house itself. This causes a sufficient slow down for implementation of new projects.

Proceeding from this, the Government must be given every support in its efforts to distribute land through land auction procedures. This provides advantages to every party: local authorities can enjoy the best price bid and investors (both foreign and Ukrainian) get an equal access and a transparent procedure for purchasing land lots. Building a house on a site bought at an auction proved the auction to be the most effective solution for all the parties involved.

Besides the fact that the issues of building residential real estate are now within the range of responsibility of the President of the country, the Ministry officials would like to control builders’ activities ‘personally’ , make the rules of attracting people’s means by investors and constructors more rigorous, improve the legislation and make the market more transparent in general. The effectiveness of imposing more ‘rigorous control measures’ has not won the trust of construction companies yet but the transparency of the market is mostly welcomed. The January 2006 Decree has regulated the procedure of attracting internal investments which have been adjusted to international standards – builders now are not allowed to accept investments from the population into residential houses under construction. A civilized way to implement this investment technique has been specified by construction financing funds which are under the control of the State Board on Regulation of the Market of Financial Services of Ukraine. The state is planning to establish a public register of contracts in order that everybody could check if the apartment he/she is buying has not been already sold ‘to somebody else’ before, as well as to add some construction control powers to the Ministry, to introduce land auctions as the only way to sell land, to specify clearly and guarantee rights and duties of investors and constructors.

Speaking about the companies working on the market of residential real estate in Ukraine it’s worth mentioning that most of them try to use the advantage of their membership of the Ukrainian Construction Association to exchange information and develop common business policies. Today this body includes about 80 economic agents engaged in real estate construction and investment. After a more rigorous procedure of issuing licenses for construction operations is completely implemented, only the most experienced and reliable players will stay on the residential real estate market. XXI Vek (The XXI Century) is one of the companies working on it. This is an investment company investing directly into real estate projects. The investment portfolio of the company includes another entity Zhylyo XXI Vek (Housing XXI Century). The mission of the Zhylyo XXI Vek is to develop and implement investment projects in the sphere of residential real estate. The company has been working on the market for almost 4 years and the volume of its current project portfolio is made of more than 10 projects. The Interservice investment company has also been operating for nearly 4 years. Investments into real estate of Kiev and the Crimea are among the priorities of the Interservice activities. The CJSC Macrocap Development Ukraine established in 1997 is one of the biggest construction and investment companies in Kharkov. It was the first in the region to start building business class residential houses. The Global Solutions (Kiev) company was established by a group of Ukrainian investors in June 2005. The Global Solutions is going to put in commission more than 70 thousand square metres of residential floor space and more than 100 thousand square metres of office floor space in Kiev and the Kiev Region before 2009. A joint-stock holding company Kievgorstroy is a multifunctional construction and financial complex working on the primary residential housing market. The company follows a policy of providing the maximum accessibility of its products for the widest range of consumers. A financial company Zhytlo-invest is engaged in attracting investments into residential construction projects as well as in mastering state investments into residential housing. As a state holding society within a new public utility corporation Zhytloinveststroy-UKB the Zhytlo-invest solves all production problems in package – from preparing construction sites to putting new houses in commission.

It’s worth pointing out that many Ukrainian companies are still practicing versatile activities. They can act simultaneously as an investor, a site owner, a property developer, a real estate agent, a design bureau etc. in one and the same person. The companies can also attract investments contracting to repay them with square metres of floor space. The same is happening to real estate agencies which often tend to declare themselves as investment companies. Such situation can easily confuse foreign investors and cause numerous misunderstandings.

The number of foreign companies on the Ukrainian market of residential real estate is much smaller but they do exist, work and develop, though a wider range of entities are still considering and planning to join this business in Ukraine. One of such companies is the UKI Investments, the main investment branch of the Schimmel Families corporation, one of the UK biggest private companies working in the real estate field. The Schimmel Families’ business interests are mainly concentrated in Great Britain, France and Israel but recently the company has increased its presence also in Eastern Europe countries and the USA. The Perry Ukraine Real Estate Investments company has carried out about 300 different real estate projects for 10 years of working in Ukraine. The company has been implementing cottage building projects orientated at the upper-medium class – 150-200 square metres of floor space for $1,500 to $2,000 per 1 square metre. An investment company Galileo Asset Management SA (Switzerland) is going to invest $3-5 million in Ukraine in 2006 via its partner company UA International Group (UAIG, Kiev). The UAIG will distribute the investments among construction, heat power industry and water supply projects. The company has already received $400 thousand for carrying out initial organizational activities. Future investment volumes will depend on the results of company’s work as well as the situation on the market. The UAIG which was established in 1994 has been closely cooperating with CJSC Swedish-Ukrainian Group (SU Group) and CJSC Kievenergomash. The company is investing into four blocks of flats (only in Kiev so far) with the total floor space of 40 thousand square metres and independent water, heat and power supplies. The total investment makes $17 million.

Many residential construction projects could be described to prove the worthiness of investing into this sphere. Certainly, there are different classes of residential houses. The Triumphal Arch in Kiev and the White Sail in Odessa could be the examples of successful projects. The Triumphal Arch is an independent 11-level block of apartments located in the centre of Kiev and facing the Khreshchatik Street (the main street of the capital city). The White Sail elite residential complex situated in Odessa 354 metres from the coastline is overlooking a perfect sea view. It has a recessive front with open penthouse platform roofs and varying number of storeys. The price is $1,200 to 6,000UAH for 1 square metre. A well developed infrastructure of the residential complex includes a fitness centre with a swimming pool, shops, sports fields and a children’s play ground. The adjacent park is also going to be reconstructed.

Thus it’s possible to conclude that the segment of residential real estate remains the most attractive and the least risk-taking for investing, followed closely by the office and commercial floor space segments. Even if the prices of the Ukrainian residential real estate happen to decrease, this will definitely take place only in those market segments where the quality parameters don’t match the prices. In this respect we mean old, tumbledown houses as well as used panel buildings. It doesn’t mean that one should expect a slump of prices. The only and natural thing that might occur is bringing prices to the levels that will match the quality of the particular residential property. Concerning new residential housing, the prices are not likely to fall. Though the demand for apartments in houses which are at their initial stage of construction is reported to be falling. Nevertheless, the prices on the primary market of residential floor space are expected to rise by at least 15-20% during 2006.

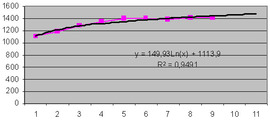

The cities of Ukraine are growing and the demand for residential real estate remains high. That’s why the prospects of investing into residential housing will improve in the nearest future. We estimate that the prices on the primary market of residential floor space will also go up. Visually this tendency is presented in Picture 2.

Picture 2. Dynamics of marketing price of 1 square metre of residential floor space on the primary market of residential real estate in Ukraine.

This forecast has been developed by means of the least square method, the brand logarithmic line has been built which demonstrates that prices of primary residential floor space will increase until they have reached their peak and stabilized. The forecast covers the periods from August 2005 to June 2006 inclusively (in the picture months are presented as numerical periods).

The real estate market of Ukraine possesses an enormous potential. Nevertheless, investors should be very careful in selecting a developing company, they should implement world accepted investment practices, base their decisions on market studies and business planning, carry out expert evaluation of construction site title documents and take advantage of cooperation with partner companies capable to navigate them in the labyrinth of the Ukrainian market. Taking into account all the factors restraining the flow of major capital into the country, as well as Ukraine’s turn towards democratic values and European standards in economy and finances, its integration into the European and world economic and trade space – all this together can turn investing of western capital into a practically inexhaustible market of Ukraine into an extremely promising challenge. This will become possible only in case if the authorities set up all necessary rules to prevent any frauds and encourage changes in working policies of the construction companies with the purpose of creating more favourable cooperation patterns, checking developers and controlling their activities as well as creating more transparent relations on the real estate market itself.