Since the end of 2008, development of many large Ukrainian office projects, which were announced for implementation before the financial crisis, has been suspended due to lack of funding, ineffective concept of projects, the economic downturn, reducing business activity and, as a result, decline in demand.

The important events of the office market in 2011 were defrosting some of the projects and the continuation of the construction several large office buildings. As a result of increased business activity during the year we could notice the increase of developers’ activeness, the increase in new supply and demand for a high quality space and, consequently, a gradual increase in rental rates and vacancy reduction.

The main factor that contributes to the development of office real estate market of Ukraine is still unsaturation of the market with high quality facilities, including such major cities as Kiev, Donetsk, Dnepropetrovsk, Odessa and Kharkov.

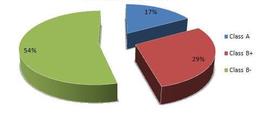

About 15 projects with a total area of 225,000 square meters were put into operation over the past 2 years in Kiev, the capital of Ukraine, i.e. the offer increased by almost 20%. And in 2012-2014 in Kiev more than 20 business centers of Class A and B can be completed with a total area of over 500,000 square meters. As a result, the proposal will increase by almost 40%. The structure of the proposal for the classes is the following: Class A – 17%, Class V + – 29% and B – 54%.

The structure of supply of the office real estate in Kiev at the end of 2011

Redistribution of the demand structure in the direction of increasing of Class A and B + is being predicted during 2012, which is possible due to the commissioning of such large-scale projects as Shopping and Office Center “Gulliver” (47.2 thousand sq. m.), “101 Tower” (43.6 thousand sq. m.), “Premium Centre” (36 thousand sq. m.), BC “Maria” (43.2 thousand sq. m.), BC “Toronto” (36 thousand sq. m.).

Entering the market such as “volume of space” (“office stock”) will allow potential tenants, on the one hand, to expand choice and focus on the most appropriate object for them and, on the other hand, it will restrain the growth of rental rates because of intensifying the competition.

Vacancy rate in the segment of office real estate in Kiev in 2011 was about 13.5%. Demand during 2011 primarily was generated by IT, telecommunications, pharmaceutical, industrial and financial sector companies (banks and insurance companies). With that, not only the capital but also almost the whole Ukraine is not interesting to the foreign investors – 99% of all transactions were made by the companies, which have been working in our country for a long time. Most likely, this trend will remain by the end of 2012. The main criterion for a change in the office space was the intention of companies to improve business conditions and / or the quality of its premises.

At the end of 2011 rental rates for Class A office space in Kiev were at $ 38-50/sq. m./month, Class B and C were offered at a rental rate $ 23-35 and $ 8-25/sq. m./month respectively (excluding VAT and operating expenses). The average level of operating expenses for Class A offices was $ 6-10/sq. m./month, for Class B – $ 2-6/sq. m./month (including VAT). These data indicate a slight increase in rental rates (4.5%) comparing to the last year.

The dynamics of rents in Kiev in the next 2 years will depend on the pricing strategies of major business centers “Gulliver”, “101 Tower» and «Toronto-Kiev”, the commissioning of which is scheduled for 2012. If the cost of rent in these business centers is too high, it can lead to further increasing of the average market rental rates for office space in Kiev. At the same time, using competitive pricing strategy of these facilities is likely to lead to lower average market rental rates in this segment.

The construction of new office buildings in the regions is moving ahead slowly, but it does not affect the prices: they are stable or declining at a moderate pace because business activity is restoring very slowly and new tenants use very economical approach for recruitment offices.

For example, in Kharkov, the range of rates of Class “B” business centers is 10-15 dollars / sq. m. The greatest demand for the office space was noticed in a small area offices (up to 50 sq. m.), but there is a trend towards the increase of demand for the large-scale offices in the office centers of Class “B” and “C”. But if the demand for a small area was covered by the current proposal, there is no vacant office area of more than 1000 square meters in the market. As in the business centers of Class “B”, the office centers of class “C” are mainly offered by small rooms or office blocks of the area of up to 300 square meters. Thus, today we can speak about the lack of high-quality office properties in Kharkov, which is a result of freezing of projects with an office component in the 2008-2011 years.

While in 2012-2013 it is planned to open several business centers with a total area of about 85,000 square meters (Class “A” – “Diamond City”, “Solomon”, Class “B” – “capitalist”, “Forum Hall”, Business Center as part of MFC “The Ark”, an exhibition center of commerce and with offices), the risks of postponing the commissioning for them are still high, considering the trends of previous years.

In Dnepropetrovsk, the proposal also exceeds the demand. In 2011, the business center of class B “Kudashevsky” (31,300 sq. m.) was commissioned and by the end of 2013 3 more BC must be entered: “Civilization” (17,900 sq. m.), BC on the Liebknecht str. (4000 sq. m.) and “Steps”, Phase II (11,800 sq. m.). That’s why in 2012-2013 further reducing of rents in the area of 3-5% is possible. Now here you can find space for the price of 6 dollars. / Sq. m.

Entrepreneurs from Odessa have to pay more – from 15 up to 25 dollars. / sq. m. There are more than 100 office buildings in Odessa at the moment with an aggregate area of which exceeds 300,000 square meters, but the market is characterized by the absence of high quality offers (more than 65% of the area is the old Soviet-era administrative buildings). The vast majority of BC has significant drawbacks and limitations. The main problem for office buildings in the heart of the city, as in other large cities, is the parking. From infrastructure (conference room, restaurant, centralized security, etc.) no more than 2 or 3 options are usually presented. In 2011 only one business center of class A was commissioned – “Negotiant” with the area of 7800 square meters. In the coming years this segment is not a priority for investors and the emergence of large objects is not expected.

Donetsk realtors also do not note and do not predict a lack of any office. The cost of renting office space in Donetsk has been reducing by 1-1.5% per month since 2011. Over 50% of Class A offices are empty, because local business does not stand up the rental price of 35 dollars. / Sq. m. in a month, although Donetsk and Kharkov were the most active commercial real estate markets in the pre-crisis period.

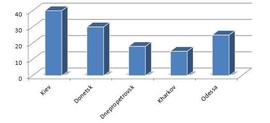

Thus, the general rental rates in Ukraine are the following:

Rents for office space in cities of Ukraine by the end of 2011 ($ / sq. m. / month)

It should also be noted that the traditional relationship between owners and tenants of office buildings have fundamentally changed. Tenants understand that now their position in the negotiations is stronger then ever – they may even affect the construction of projects, paying attention to everything: location, size, energy efficiency and environmental quality of the object, the presence of security and air conditioning systems. Also, tenants of office space are increasingly focused on the presence of high-quality transport interchange, guaranteed parking spaces and infrastructure in BC. In particular, many companies welcome the presence of opening window systems after not very successful experience of being in fully pressurized buildings with low-power air conditioning / ventilation systems.

And this trend, which has a long history in the office real estate markets of European countries, presents favorable conditions for all parties. Tenants need efficient workplace, and developers need first-class tenants. And the question is whether developers can build long-term partnerships with their clients by offering facilities that will enhance the effectiveness of the tenants. Both sides need to follow the principle of equal partnership to achieve mutually beneficial results.

The main players in the field of office real estate development in Ukraine still will be local players with local investment, since frankly non-transparent procedures of obtaining land and construction activities may be controlled only by the local developers who have leverage on administrative resources. Therefore, if the foreign development companies even enter the Ukrainian market of office real estate in the nearest time, it is likely that they will involve a local partner with the administrative resources and existing land, projects or a consulting company which provides the entry and work on the market (if they know that in Ukraine it is better to implement projects on their own). It is not a secret that out of 100% of successful investment projects of foreign companies in Ukraine, only 1% (1 project) is realized with the participation of Ukrainian partner. All other projects are suspended under various pretexts and their fate is unknown.

On account of the substantial increasing in the supply of premium office real estate we can assume that the rental rates in the most expensive segment of the Ukrainian office space should go down. However, only slightly more than a half of the promised facilities are likely to be put into operation, like in case with commercial real estate. The imbalance between supply and demand will lead to some discounts for tenants, but the period of decline in rental rates will be fairly short (not more than 5%) because offering in this segment will be low since the opening of new office buildings in 2012/2013. For this reason, the demand in approximately 12-18 months will cover all the new proposal, and rental rates in this segment could increase again.

If we talk about the dynamics of the past two years, the rents are now at the rate of the end of 2009, but they will not be able to catch up the pre-crisis levels. Vacancy of different levels was observed depending on the real estate objects. Thus, significant variations are observed in the segment of the objects of class A from 0% to 75%.

Overall, 2011 was marked by the increasing number of transactions in the rental market. The share of transactions of purchase of premises by the end users was about 25% in total demand, respectively, the share of lease transactions – 75%. Among the investment deals in the office market the most significant purchase was a 50% stake in the second stage of the business center “Leonardo” in the central part of Kiev by “Esta Holding” in the fourth quarter of 2011. It was the largest transaction in 2011 in Ukraine ($ 50-60 million) in acquiring an asset that generates income. Besides, in the first quarter of 2011 the TV channel “1+1” acquired a business center “Schekavitsky” in Kiev for their own use, a total area of which is 12.12 sq. m.. The total amount of the transaction estimated at approximately $ 25 million.

It is difficult to forecast the development of commercial real estate industry for a long period, as well as in the short term. This is due to both the political and economic life of Ukraine on the eve of the forthcoming elections to the Verkhovna Rada and the lawmaking of its new membership and to the crisis excitements in the world and Europe in particular. In this regard, it is left to hope that after the parliamentary elections, the business environment and investment attractiveness of Ukraine will be improved. This will contribute to the growth in demand from tenants, and the global market conditions will lead to the increase of the investment activeness of foreign investors in direction of Ukraine, which will have positive impact on the development of new business-center projects and the timely completion of already planned.