How does the banking sector of Ukraine get along in 2012? The Ukrainian banking system faces the same challenges as the systems of other countries do. Presently there is a big possibility of the second turn of the world crisis to come, which can have a negative impact on the country’s economics on the whole and particularly on the banking system. But despite expectations of the new surge of the crisis plans of Ukrainian banks for 2012 are quite pragmatic.

The banking sector of Ukraine shows a lot of positive tendencies. As the National Bank of Ukraine notes, growth rates of the key indicators of Ukrainian banks development are comparable and even a little bit exceed the performance achieved by banks of EU countries. Results of 2011 demonstrated that the banking system assets increased by 11%, credits – by 9% (including ones in national currency), regulatory capital – by 11% and private persons’ deposits increased by 13%. In 2012 the banking system of Ukraine has been showing breakeven results for 3 consecutive months – the banks’ profit in the 1st quarter amounted to 1.7 billion UAH compared to losses incurred a year before. In addition, a number of positive legislative innovations were implemented in Ukraine. In particular, the laws concerning improvement of banks’ transparency in terms of consolidated supervision and protection of creditors’ rights were adopted.

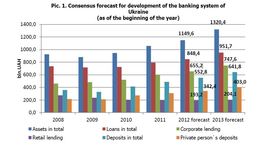

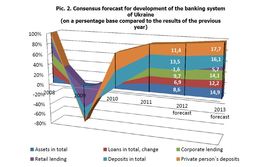

The positive changes in the banking system of Ukraine and improved effectiveness of Ukrainian banks activity can be proved by the consensus forecast for the banking system development prepared by the experts of Forum of leading international financial institutions (FLIFI) (pic. 1, 2).

Source: NBU, consensus forecast prepared by the analysts of UniCredit bank, Raiffeisen Bank Aval, OTP, ING Bank and Erste Bank.

As it can be seen from the pic. 1 and 2 the consensus forecast predicts that in 2012 the banks’ assets will increase by 8.6% and in 2013 – by 14.9%. At the same time loans volume according to the results of the current year are expected to grow by 6.9 %, and in 2013 – by 12.2 %.

By experts’ estimate corporate clients lending shall gain 9.7 % in 2012 and 14.1% in 2013 while retail lending shall go down by 1.6% in 2012 and go up by 5.7% in 2013.

In general Ukrainian banking sector in 2012 is nothing more than a reproduction of the current financial market environment. In the next few years the most realistic shall be two clear scenarios of macro-economical changes (pic.3).

The following trends shall be basic for any scenarios of the banking sector development in the next years:

- reaching synergies when working with different clients segments;

- focusing on clients with average and above the average level of inco

- developing remote systems of customer assistance;

- increasing quality of risk management;

- expanding distribution channels.

However, considering the positive scenario, particularly relative currency stability and lowering of pressure at the world debenture markets, one can anticipate stabilization of national banking sector and setting of positive tendencies. The banking sector’s assets dynamics can reach 8-12%, and credit activities in 2012 – 5% with further growth up to 10%. Also uneven recovery of past-due arrears with remaining in a trend for its lowering by means of creation of provisions and keeping quality of credits at high level can be announced.

To address the consequences of the negative scenario National Bank of Ukraine has taken a number of preventive measures among which should be mentioned: increase of regulatory capital (from 120 million UAH and higher) and introduction form January 1, 2012 a new regulation regarding proportion of regulatory capital to bank liabilities – Н3-1 (no less than 10%). These and other measures have been taken to reduce risks in banking system and fuel confidence in banking sector on the whole.

In view of everything aforesaid it is possible to predict that in the nearest three years the banking sector will pass a challenging way of quality growth aiming at further increase of capitalization and liquidity rate as at the moment banks of Ukraine, due to the fact of NBU’s adoption of regulatory acts, are prepared to ensure their stability in case of any force-majeure circumstances.