Ensuring of favourable investment climate in Ukraine remains to be a task of strategic importance, implementation of which can have an impact on social and economic dynamics, effectiveness of involvement into international division of labour and possibility of modernization of national economics on this basis.

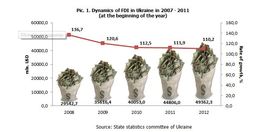

Considering foreign direct investments (FDI) volumes since 2007 till 2011 it is possible to notice the tendency of their growth from year to year (pic. 1). This tendency proves the fact that Ukraine is investment-attractive at the global stage.

As it can be seen in the pic. 1, FDI volume as of January 1, 2012 amounts to 49362.3 mln. USD which is 10.2 % higher than the volume of investments as of the beginning 2011 and if calculated per person makes up 1084.3 USD. Such result was possible to achieve mainly due to stabilization of macro-economical and political situation in the country. It should be noted that achievement of this goal took place even in conditions of unfavourable economic conditions and ratings fall.

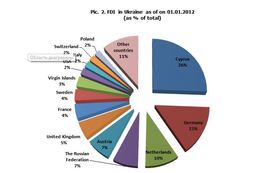

Investments in Ukraine were received from 128 countries, among them should be mentioned 10 main countries-investors covering 83% of the total volume of FDI (pic.2).

During 2010-2011 Ukraine adopted a number of regulatory legal acts which had positive impact on investment climate of Ukraine. Due to significant efforts paid to establish adequate organizational and economical as well as legal basis for strengthening investment climate international experts note improvement of investment attractiveness of Ukraine. Thus, according to the annual ratings survey held by International financial corporation, World bank group “Business leading 2012”, Ukraine though changing its position for the worse from 149 down to 152 still improved its rating by such categories as: “business establishment”, “obtaining permissions for construction” and “insolvency negotiation”. (tabl. 1).

Table 1

Doing Business rating as an indicator of favourability for investment climate

|

Ratings by categories |

2012 |

2011 |

Changes in ratings |

|

Business establishment |

112 |

118 |

+ 6 |

|

Procedures (quantity) |

9 |

10 |

– 1 |

|

Time (days) |

24 |

27 |

– 3 |

|

Costs (% of per capita income) |

4,4 |

6,1 |

– 1,7 |

|

Minimal capital (% of per capita income) |

1,8 |

2,2 |

– 0,4 |

|

Obtaining permissions for construction |

180 |

182 |

+ 2 |

|

Procedures (quantity) |

21 |

21 |

Without changes |

|

Time (days) |

375 |

375 |

Without changes |

|

Costs (% of per capita income) |

1462,1 |

1731,4 |

– 269,3 |

|

Insolvency negotiation |

156 |

158 |

+ 2 |

|

Time (years) |

2,9 |

2,9 |

Without changes |

|

Costs (% of the property cost) |

42 |

42 |

Without changes |

|

Recovery rate (cents per 1 USD) |

8,9 |

7,9 |

+1 |

Source: The International Bank for Reconstruction and Development: Doing Business 2012

As it can be seen from the tabl. 1, during 2011 a number of administrative barriers against business were removed. Thus, in comparison with the previous year were implemented such positive changes as reduction of amount of required procedures, time, costs and amount of minimal capital to establish a business. Moreover, the cost of permission to start a construction was reduced and at the same time recovery rate in case of a business insolvency was increased.

At the moment Ukraine has created developed legal environment for investments. Ukrainian legislation provides indispensable guarantees for investors’ activities. On the territory of Ukraine foreign investors are assisted by national regulations for investment activity, i.e. they find themselves in equal conditions with native investors. Foreign investments in Ukraine are not subject to nationalization.

In case of cessation of investment activity a foreign investor will reliably receive return on investments in natural form or in the currency of investments without duties as well as investment income in monetary or commodity form. The state also guarantees free and immediate transfer of income and other means in foreign currency abroad if received legally as a result of foreign investments made.

To improve protection of foreign investors by the Law of Ukraine dated 16.03.2000 No. 1547 The 1965 Convention on the Settlement of Investment Disputes between States and Nationals of Other States was ratified.

Verkhovna Rada of Ukraine signed and ratified intergovernmental agreements on promotion and mutual protection of investments with more than 70 countries.

To support foreign investors on their communications with executive authorities and local government bodies State agency for investment and national projects of Ukraine was founded.

During 2010-2011 a number of legislative acts were adopted to assist the improvement of investment climate in Ukraine. (tabl. 2)

Table 2

The main legislative acts having a positive impact on investment climate (adopted in 2010-2011)

|

Name of the document |

Key provisions |

|

Administrative barriers |

|

|

The Law of Ukraine “On amendments to some legislative acts of Ukraine regarding crediting and promotion of foreign investments” dated 27.04.2010 No. 2155 |

The requirement to register foreign investments and necessity to register investments in compliance to 2 different procedures were raised. |

|

The Law of Ukraine No. 2623 “On preparation and implementation of investment projects under the “one window” principle” (comes into force from January 1, 2012) |

This Law specifies legal and organizational framework of relationships connected with preparation and implementation of investment projects under the “one window” principle. |

|

The Law of Ukraine No. 2404-VI dated 01.07.2010 “On public-private partnership” |

It specifies legal, economic and organizational framework for implementation of public-private partnership in Ukraine, namely the control of relationships arising from implementation of projects in some specific spheres of economic activity. |

|

The Law of Ukraine No. 2880-VI dated 23.12.2010 “On amendments into some legislative acts of Ukraine regarding guarantees for concessioners’ rights”. |

The Law introduces alternations into the Land Code of Ukraine and the Law of Ukraine “On concessions” in order to enhance state guarantees for concessioners’ rights protection which shall create favourable conditions for combining interests of the state and business entities when entering and executing public-private partnership agreements. |

|

Tax environment |

|

|

Tax Code dated December 2, 2010 |

The Tax Code comprises a number of innovations concerning investment activities, particularly: stimulation of Ukraine’s transfer to an innovative model of development; temporary release from profit taxation of bio-fuel producers; release from taxation for the period of ten years starting from January 1, 2011 the profit obtained from hotel services provision; and there is a created background for investment attractiveness of the country by means of reducing VAT rate down to 17% etc. |

|

The permit system |

|

|

The Law of Ukraine “On amendments into The Law of Ukraine “On Permit system in the sphere of economic activity of the basis of declaration submitting” d.d. 07.07.2010 No. 2451-VI. |

In compliance with this Law a business entity obtains the right to carry out some actions in its business activities without obtaining any permit document but by means of notifying an administrator or a relevant authority about conformity of its material and technical base with legal requirements (further on referred to as declaratory principle). |

|

Licensing |

|

|

The Law of Ukraine “On amendments into some legislative acts of Ukraine regarding restricting of state control of economic activity” dated 19.10.2010 No. 2608-VI |

The Law canceled licensing of 23 out of 66 types of activity whose carrying out does not pose a threat to the national security, or people’s life and health, or state of environment and which are otherwise regulated by the government (government standards, construction rules and regulations, technical conditions, international quality standards etc.) |

Source: Official web-site of the Ministry of foreign affairs of Ukraine

As shown in the tabl. 2, within the reviewed period quite a few legal documents were adopted to revive investment activity and attempts to improve investment climate in the country and a number of administrative barriers were removed to significantly develop conditions of doing business in Ukraine.

The important factor for improving investment activity shall become implementation of projects for preparation of the final part of Euro 2012 footfall championship in Ukraine whose biggest amount of financing will fall on 2011-2012.

The issues regarding investments promotion were set forth in the Program of economic reforms for 2010-2014 named as “Prosperous society, competitive economy, effective state”. In particular as a part of the reforms program some specific measures will be taken to improve business environment, namely: advanced development of the permit system, licensing, administrative services, a business establishment and liquidation, state monitoring and control, technical regulation and tax procedures formation.

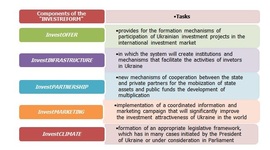

On April 6, 2011 the government reviewed and adopted the Investment reform of Ukraine. The general and the main aim of the reform is active involvement of foreign direct investments into Ukraine’s economy, forming a positive image of Ukraine in the world and positioning of Ukraine as a financial, political and business centre in the Eastern Europe. The structure of the investment reform constitutes 5 key clusters: (pic. 3)

Pic. 3. The concept of the Investment reform in Ukraine

As it can be seen in the pic. 3, due to specific instruments, provided by the Investment reform, it is planned to drastically increase the volume of borrowed capital in national economics, implement strategically important courses of economy development; establish institutional conditions for technological modernization and innovations, introduce new principles of state administration, upgrade mechanism of management of budget funds for development; create an effective mechanism to develop investment proposals (projects); apply complex planning for development of regions on the basis of investment plans.

Unfortunately many investors do not even have an idea that Ukraine having huge internal market, rich resources and useful geopolitical location can become one of the leading recipients of investments for those business and active people who are looking for new markets to invest their business ideas, initiatives and entrepreneurial spirit.